In this blog entry, I’ll take a look at the range of consolidations in the market and what public data shows us about returns (multiples, exit value etc) and who might be next. I’ll also continue to update this entry as new transactions occur. So be sure to check back.

To begin with, the Cloud Native technologies market continues to be a rapidly expanding and rapidly changing market full of emerging technologies and technology companies tackling the broad spectrum of infrastructure and developer solutions required for companies to capitalize on this next wave of innovation and differentiation in the “Multicloud”.

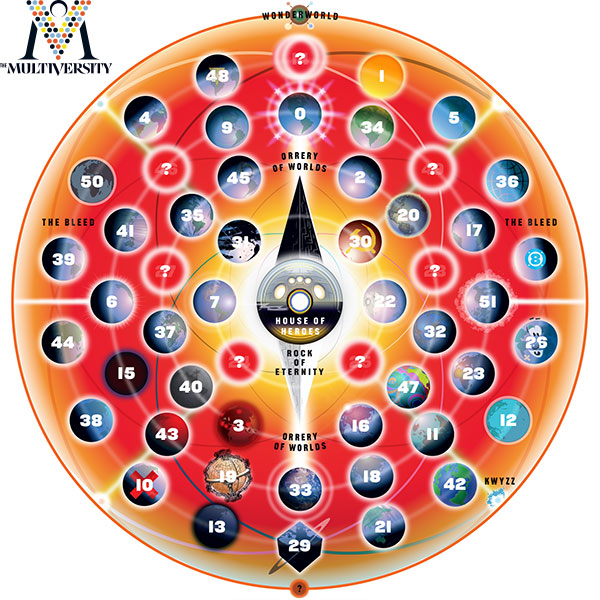

That’s right, I’m playing off of Marvel/DC comics Multiverse, since that is in fact what we have today. There is no one Cloud, just like there is no one Earth in comic lore. Between cloud service providers like Amazon, Google, Azure, DigitalOcean, IBM, Oracle, others; combined with content delivery networks (CDNs) Akamai, Cloudflare; and interconnected SaaS applications and services – we have the “Multicloud”. Quick aside for comic fans, multiverse (earth 616) first appeared in 1939’s Motion Picture Funnies #1 (now Marvel) and DCs The Flash #123 in 1961.

Cloud-native technologies to realize the Multicloud span categories including container management (kubernetes), policy management, storage, security, continuous integration / continuous delivery, monitoring, data services, serverless applications (functions as a service), key SaaS applications and edge technologies.

While there have been a number of Big Fish consolidations from Red Hat, VMware, IBM and others over the last two years it only represents the first wave. You only have to look at the number of companies participating in the industries benchmark event KubeCon, put on by the Cloud Native Computing Foundation (CNCF.io) where there were more than 200 companies and startups with more than 15,000 attendees. The largest of any of these events yet.

To get an idea about what this could mean for investors we consolidated 2009-2019 public data from sources such as public company press releases, 10Ks, Crunchbase, Pitchbook for 17 exits across cloud native categories. While public data on transaction value was only available for 60% of the companies we were able to derive some interesting data.

For the acquisitions we were able to identify across all categories we found the estimated average multiple to be approximately 8.95x with an averaged exit price of $400M. The range was between 5x and 16x so your mileage could vary, as always. The return period from company formation to exit averaged approximately 5.2 years.

To get the average multiple we used the public capitalization prior to acquisition in combination with the exit price, from the sources listed above. Company exits included in the initial analysis include: CoreOS, Cloud Health, Heptio, Twistlock, NanoSec, Verodin, Puresec, Recorded Future. We will continue to update the results as more exits occur.